Crime and Law

FG sues Access Bank over alleged fraud

Federal Government has filed a lawsuit against Access Bank Plc and one of its employees over the alleged fraudulent diversion of N825.9 million in state funds.

The charges was filed at the Federal High Court in Sokoto, following an investigation by the Independent Corrupt Practices and Other Related Offences Commission (ICPC).

According to court documents obtained by this publication, the bank and Abdulmalik Abubakar—a relationship manager at Access Bank’s Sokoto branch—face a four-count charge involving conspiracy, money laundering, and concealment of stolen public funds.

In the first count, the prosecution alleges that the defendants created a fake “Internal Revenue Service Account” (Account No. 1873016763) and funneled N825.9 million into it between May 2024 and January 2025. This action is said to violate provisions of the Money Laundering (Prevention and Prohibition) Act, 2022, as well as the Corrupt Practices and Other Related Offences Act, 2000.

The second charge accuses the duo of hiding the funds through the fraudulent account. According to the prosecution, this act contravenes Section 18(2)(a) and is punishable under Sections 18(3), 18(4), 22(1), and 22(2) of the 2022 Money Laundering Act.

In the third count, prosecutors claim the money was illicitly received through the fake account, an offence under Section 13 of the Corrupt Practices Act and punishable under Section 68.

The fourth count alleges direct concealment of the laundered funds, a violation punishable under Section 24 of the same act.

The state asserts that the funds were misappropriated without proper authorization and hidden in violation of anti-corruption and money laundering laws.

Hearing Details

According to a hearing notice dated May 2, the case has been moved from the General Cause List and is scheduled for hearing on May 19—subject to the court’s availability. If not heard on that day, the matter may be postponed without further notice.

The notice emphasizes that all parties must present their full evidence—including documents and witnesses—during the hearing. Any party needing a witness must request a court summons promptly and must also cover any related expenses as determined by the court.

If a party intends to use documents held by the other party, they must provide prior written notice. Failure to comply could lead to exclusion of evidence.

The notice was issued by court order.

When contacted, Access Bank spokesperson Kunle Aderinokun said the bank would issue an official statement in due course.

Premium Times

-

National News1 day ago

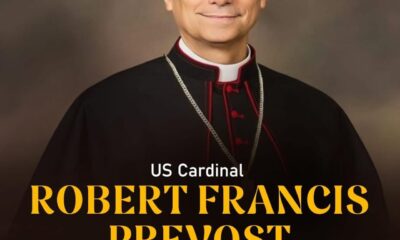

National News1 day agoPope Leo holds inaugural mass, condemns exploitation of the poor

-

Metro News2 days ago

Metro News2 days agoBala approves new salary, welfare package to lure doctors, health workers

-

Politics1 day ago

Politics1 day agoFubara is my son – Wike

-

Metro News1 day ago

Metro News1 day agoZulum declares Monday fasting, prayer day

-

Politics10 hours ago

Politics10 hours ago2027: Atiku offers Peter Obi VP’s role amid coalition

-

Metro News1 day ago

Metro News1 day ago“Get ready to be sacked,” Nigerian governor warns commissioners

-

Entertainment1 day ago

Entertainment1 day agoDino Melaye faces backlash over $3.9 million James Bond car

-

Education1 day ago

Education1 day agoPanic as 15 students reportedly go missing on their way to JAMB centre