National News

Shun ponzi schemes – EFCC warns Nigerians again

In line with the prevention mandate of the Economic and Financial Crimes Commission (EFCC) and its commitment to sensitize and enlighten Nigerians on the negative impact of Ponzi schemes on the economy, the Acting Zonal Director, EFCC, Enugu Zonal Directorate, Assistant Commander of the EFCC, ACE I Aisha Abubakar has charged Nigerians to shun Ponzi schemes, as they have destroyed lives, eroded trust and undermined national development.

Abubakar gave this charge at the weekend, during the 2025 Annual Management Retreat of the Nigeria Security and Civil Defence Corps which was held at Jubilee Hall, Holy-ghost Cathedral, Ogbete, Enugu State.

Speaking on the topic, “Get-Rich-Quick Syndrome and the Youth Vulnerability: The Case Study of Ponzi scheme-The Role of Law Enforcement in Prevention and Disruption”, Abubakar said that the get-rich-quick syndrome has become a serious economic and security threat in Nigeria, with the youths bearing the brunt. She said that the get-rich-quick syndrome is a mindset characterized by the desire to attain wealth without legitimate, gradual effort, adding that the craving is often fueled by social media portrayals of instant riches and social pressure.

“In Nigeria today, the aspiration for wealth has grown increasingly urgent among the youth, leading to vulnerability to financial frauds such as Ponzi schemes. They often fall victim to enticing schemes that offer double returns within short timeframes, despite the absence of legitimate business operations. The desperation to escape poverty and fund small projects pushes many into high-risk unregulated investments”, she said.

While citing the causes of get-rich-quick syndromes among the youths, Abubakar said that greed, financial illiteracy, peer pressure, social pressure, digital and technological exposure, drugs, disappearance of cherished family and societal values, extravagant lifestyle, depression, unproductive lodging in hotels, impatience, frustration with traditional systems and psychological factors are some of the things that cause many to fall prey to schemes “even when they suspect it’s too good to be true”.

“Notable examples in Nigeria include, MMM Nigeria, MBA Forex, Chinmark Group and CBEX. In April 2025, Nigeria witnessed one of its most devastating financial scams with the collapse of CBEX, a digital asset trading platform that operated as a Ponzi scheme. It promised investors a 100% return on investment within 30 days, leveraging on the allure of cryptocurrency trading and artificial intelligence-driven strategies”, she said.

Abubakar listed types of get-rich-quick syndromes which include advance fee fraud, fake jobs and scholarship schemes, online loan and grant scams, fake forex and crypto currency platforms, amongst other.

She said that cybercrimes, which she identified as an activity of get-rich-quick syndrome, have adverse effects on the country’s economy. She lamented that cybercrime has earned the nation a bad reputation in the global world, thereby reducing foreign investments in Nigeria, which has affected in totality, the growth of our economy. She said that the reputational damage affects even individuals in Nigeria, as the global world has no confidence in Nigerians, within and outside the borders of the country.

“Cybercrime has created a market system where fraudsters obtain competitive advantage and drive out legitimate business. A lot of funds are lost to internet fraud, some of which are eventually used to fund organized crime groups and terrorism, potentially leading to further crime and terrorist attacks. I am sure you will agree with me that it has also undermined national defence and security in Nigeria and this has contributed to negative output in the economy”, she said.

She thereafter discussed the roles the Commission has played in the prevention and disruption of these schemes.

“Through roadshows, social media campaigns and partnerships with youth-focused institutions, the EFCC has raised awareness of fraudulent investment scheme. We partner with the Central Bank of Nigeria, the Security and Exchange Commission, Banks and global bodies like the INTERPOL to trace funds, monitor financial flows and disrupt scam networks”, she said.

The Retreat, themed “Developing Leadership for a New Paradigm”, had in attendance, One hundred and forty (140) NSCDC top management staff, drawn from across the agency’s formations in Enugu State.

-

Politics2 days ago

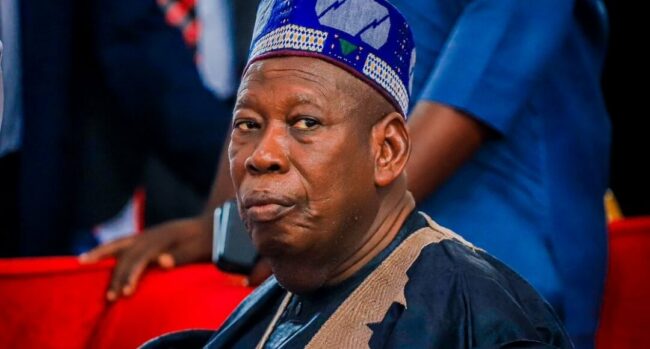

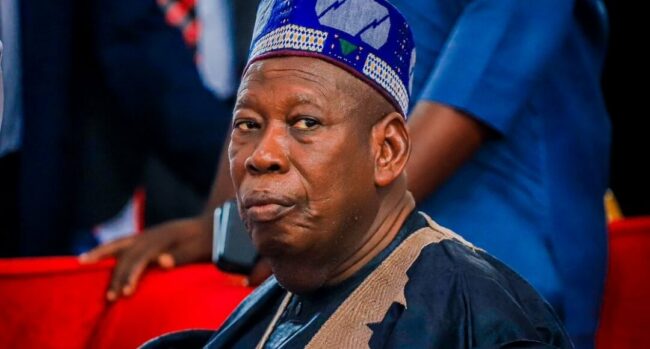

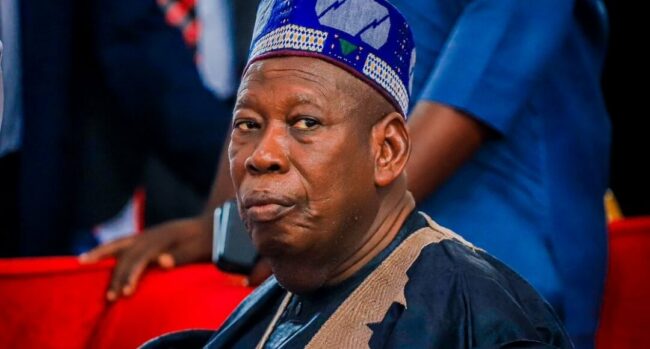

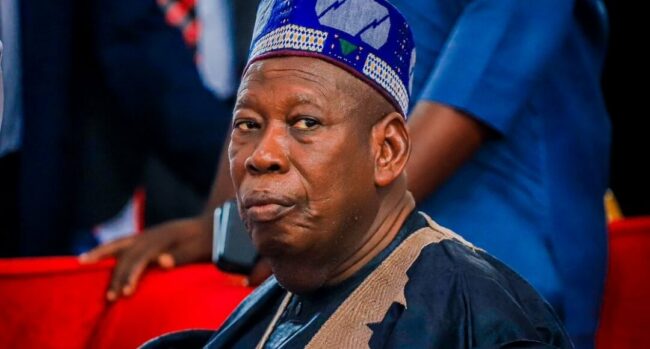

Politics2 days agoBreaking: Ganduje resigns as APC national chairman

-

National News1 day ago

National News1 day agoBreaking: Popular businessman Aminu Dantata announced dead

-

Politics1 day ago

Politics1 day agoAPC confirms Ganduje’s resignation, appoints acting national chairman

-

Entertainment1 day ago

Entertainment1 day agoHe blocked me after I helped him,” TikToker Peller accuses Portable of betrayal

-

Sports1 day ago

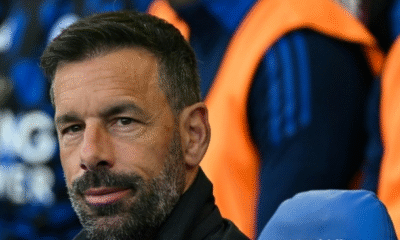

Sports1 day agoVan Nistelrooy leaves relegated Leicester

-

Politics1 day ago

Politics1 day agoGanduje’s resignation: Rebalancing power, safeguarding 2027, by Dauda Adamu

-

National News2 days ago

National News2 days agoPolice nab gunrunners using NANS-plated vehicle

-

Sports1 day ago

Sports1 day agoReal Madrid: Modric makes history at Club World Cup