Business

CBN appoints new board for Polaris bank

The Central Bank of Nigeria (CBN) has announced the appointment of a new ten-member Board of Directors for Polaris Bank, Nigeria’s leading digital commercial retail bank.

This move mark the significant progress made by the new management team and sets the stage for the bank’s future growth.

Leading the newly constituted board is Dr. Kassim Gidado, who brings over 35 years of experience in engineering, project management, and strategic development. He is set to provide dynamic leadership as the Board Chairman. Dr. Gidado’s extensive experience spans both the public and private sectors, including his time as Group Managing Director and Chief of Staff at MAG Group Limited, where he oversaw a portfolio of companies across 35 countries. He also played a key role in developing the North-East Stabilization and Development Master Plan (NESDMP), positioning him as a valuable asset to Polaris Bank.

The board also includes other notable non-executive directors such as Dr. Akwa Effiong Okon, Mallam Ambursa Abubakar Umar, Mrs. Ayaba M. Ayo-Joseph, Mrs. Subulade Giwa Amu, and Dr. Onosode Christopher, all of whom bring diverse experience and expertise from various sectors.

Dr. Okon, a Chartered Accountant and lawyer, has a wealth of experience in the finance and banking industries. He has held roles such as the Managing Director at Akwa Savings and Loans Limited and a special assistant at the Niger Delta Development Commission (NDDC). Mallam Ambursa Abubakar Umar, an expert in enterprise transformation, has over 30 years of banking experience, including significant roles at the Central Bank of Nigeria.

Mrs. Ayaba Ayo-Joseph, with over 30 years of banking experience, played a pivotal role at Bank PHB during a critical transition period. Her expertise in corporate governance and strategic planning will be crucial as the bank continues to evolve. Mrs. Subulade Giwa Amu, with a background in law and business management, brings over 30 years of experience in financial services and real estate. Dr. Onosode Christopher, an economist, has over three decades of experience working with major corporations like Shell and PricewaterhouseCoopers, further enhancing the board’s capacity to drive strategic initiatives.

The new non-executive directors will support the executive management team, led by Managing Director/CEO Kayode Lawal. Lawal, a seasoned professional with over 30 years of banking experience, previously served as Executive Director at Sterling Bank and has been recognized for his leadership in corporate and investment banking.

Joining Lawal on the executive team are Chris Ofikulu, Executive Director of Retail and Commercial Banking; Abimbola Ozomah, Executive Director of Corporate and Investment Banking; and Sharafadeen Muhammed, Executive Director of Operations. Each of these individuals brings decades of experience and specialized skills, positioning Polaris Bank for continued success in Nigeria’s digital banking sector.

Lawal expressed excitement about the appointments, noting that the diverse backgrounds and expertise of the new board members would drive Polaris Bank’s strategic goals forward. “We are thrilled to welcome these seasoned professionals to the board of Polaris Bank. Their diverse expertise and leadership qualities will be invaluable as we drive our strategic initiatives aimed at strengthening our position as a leading digital bank,” Lawal said.

-

Crime and Law2 days ago

Crime and Law2 days agoImo community decries killings, seeks urgent government action

-

Sports2 days ago

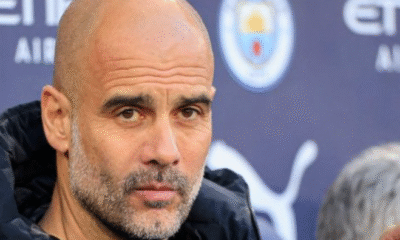

Sports2 days agoPep Guardiola speaks on Manchester City Champions League qualification

-

Sports2 days ago

Sports2 days agoAncelotti’s possible Brazil squad leaked

-

Politics2 days ago

Politics2 days agoAbia: Why Tinubu should shun Alex Otti’s invitation to commission one project – Orji

-

Crime and Law2 days ago

Crime and Law2 days agoTerrorists storm church, kidnap female worshippers in Kebbi

-

National News1 day ago

National News1 day agoBreaking: NCoS launches manhunt as 7 inmates escape in Osun

-

National News1 day ago

National News1 day agoTinubu removes top govt official, appoints replacement

-

Crime and Law20 hours ago

Crime and Law20 hours agoUpdated: Police react to death of 14-year-old boy during traffic chase in Ibadan