National News

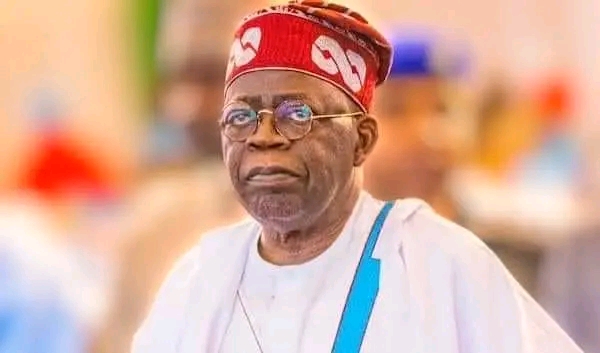

Tinubu orders release of N50bn from EFCC recovery

The Managing Director of the Nigerian Consumer Credit Corporation (Credit Corp), Mr Uzoma Nwagba, has applauded President Bola Ahmed Tinubu for releasing N50 billion from the Recovery Account of the Economic and Financial Crimes Commission.

Nwagba described the Presidential directive to release the funds to his Corporation as strategic and fulfilling.

He stated this in Abuja on Thursday, September 19, 2024, while on a courtesy visit to the Executive Chairman of the EFCC, Mr Ola Olukoyede, at the Commission’s corporate headquarters.

He disclosed that his Corporation, with a take-off grant of N50 billion, had commenced disbursement of credit facilities to civil servants, and their feedback was highly encouraging.

He expressed delight and satisfaction with the EFCC’s focus on the preventive framework in driving the anti-corruption fight, explaining that the modality aligned with his Corporation’s mandate.

“ I think our mandate is critical for the EFCC and our partnership because it tackles the corruption issue from a prevention standpoint. People have less incentive to be corrupt and have less incentive to amass wealth if they have a system and an infrastructure that allows them to meet their basic needs.”

“I admire and respect the EFCC’s focus on prevention and recovery, I like expanding the efforts around prevention. We have a job quite complementary to that: Assessing fraud and corruption risks,” he said.

In his response, Olukoyede expressed delight with Credit Corp’s mandate, pointing out that it aligned with the EFCC’s mission.

He particularly recalled his address on the need for transactional credits, stressing that no consumer intervention mechanism can insulate the nation from corruption other than the credit system. He commended President Tinubu for his vision and practical approach to the fight against corruption, pointing out that the consumer credit system would greatly assist Nigerians by reducing their propensity for economic crimes.

“ Like you rightly said, our mandates align. Of truth, one of the key points I made on the floor of the National Assembly when I was screened for this appointment was the need for us to adopt a transactional credit system. No economy can survive without it”, he said.

He charged Nwagba with paying close attention to regulation compliance so that the consumer credit system would yield optimal values.

“Regarding regulatory compliance, we still have a long way to go. That is why you need to ensure that the issue of compliance is taken seriously. To ensure that the thing gets to the right beneficiaries so that one financial corporation does not just sit on it, divert it and give it out at higher interest as you have described”.

He particularly stressed the need for a low interest rate regime for consumers, maintaining that a single-digit interest rate would better serve the interests of the credit system and greatly reduce poverty among Nigerians.

“We are not seeing this as one of those policies; we are seeing it as something that has the potential of taking Nigerians out of poverty”, he said.

He assured Nwagba that the EFCC would continue to support Credit Corp to ensure that the President’s vision in this regard is achieved.

-

Opinion2 days ago

Opinion2 days agoWhy Tinubu is not weaponising poverty – Ogala

-

National News1 day ago

National News1 day agoBreaking: FG declares June 6, 9 public holidays to mark Eid-ul-Adha celebration

-

Politics2 days ago

Politics2 days agoBreaking: Buhari’s minister dumps APC in Nasarawa ahead of 2027

-

National News2 days ago

National News2 days agoYour anti-Tinubu coalition will fail, APC cheiftain tells Atiku, Obi, others

-

Business2 days ago

Business2 days agoFidelity Bank expands, opens 3 more branches across Nigeria

-

Metro News2 days ago

Metro News2 days agoGovernment declares Monday public holiday

-

Politics2 days ago

Politics2 days agoOpposition will unseat Tinubu in 2027 – Amaechi

-

Politics2 days ago

Politics2 days agoYou conspired, removed Jonathan yet nothing changed, Dickson tells Amaechi, Atiku, others