National News

Breaking: Tinubu announces date to sign tax reform bills into law

President Bola Tinubu will, on Thursday, sign into law four tax reform bills that will “transform Nigeria’s fiscal and revenue framework.

Special Adviser to the President on Information and Strategy, Bayo Onanuga, disclosed this in a statement he signed Wednesday evening titled, ‘President Tinubu signs four tax bills into law tomorrow.’

The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.

“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Onanuga said.

The presidential assent to the bills at the Presidential Villa, Abuja, will be witnessed by the Senate President, Speaker of the House of Representatives, Senate Majority Leader, House Majority Leader, chairman of the Senate Committee on Finance, and his House counterpart.

The Chairman of the Governors Forum, Abdulrahman Abdulrazaq of Kwara State; the Chairman of the Progressives Governors Forum, Hope Uzodinma of Imo State; the Minister of Finance and Coordination Minister of the Economy, Wale Edun; and the Attorney General of the Federation, Lateef Fagbemi, will also attend the ceremony.

One of the four bills is the Nigeria Tax Bill (Ease of Doing Business), which aims to consolidate Nigeria’s fragmented tax laws into a harmonised statute.

“By reducing the multiplicity of taxes and eliminating duplication, the bill will enhance the ease of doing business, reduce taxpayer compliance burdens, and create a more predictable fiscal environment,” said the Presidency.

The second bill, the Nigeria Tax Administration Bill, will establish a uniform legal and operational framework for tax administration across federal, state, and local governments.

The Nigeria Revenue Service (Establishment) Bill, the third bill, repeals the current Federal Inland Revenue Service Act and creates a more autonomous and performance-driven national revenue agency— the Nigeria Revenue Service.

It defines the NRS’s expanded mandate, including non-tax revenue collection, and lays out transparency, accountability, and efficiency mechanisms.

The fourth bill is the Joint Revenue Board (Establishment) Bill.

It provides for a formal governance structure to facilitate cooperation between revenue authorities at all levels of government. It introduces essential oversight mechanisms, including establishing a Tax Appeal Tribunal and an Office of the Tax Ombudsman.

-

National News1 day ago

National News1 day agoIsrael won’t dare Iran again – Fani-Kayode applauds Khamenei’s defiance

-

National News1 day ago

National News1 day agoSecurity operatives arrest suspects behind Yelwata attack

-

National News2 days ago

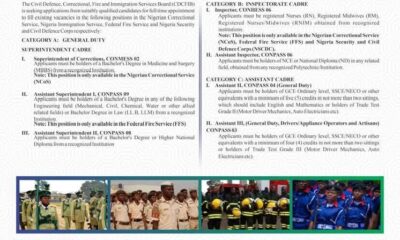

National News2 days agoThings to know about 2025 Civil Defence, Correctional, Immigration recruitment

-

Entertainment1 day ago

Entertainment1 day agoBBNaija S9: Zion, Chinwe trade blame over nreakup at reunion

-

National News1 day ago

National News1 day agoIran confirms ceasefire agreement with Israel

-

National News1 day ago

National News1 day agoAkeredolu’s widow cries out as Aiyedatiwa demolishes Owo memorial

-

National News1 day ago

National News1 day agoIsrael agrees to Trump’s ceasefire proposal with Iran – PM Netanyahu

-

Politics1 day ago

Politics1 day agoTinubu’s mate: Barau cautions northern groups, rejects Shettima’s seat