National News

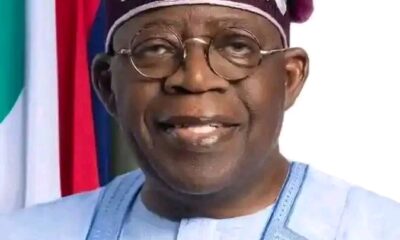

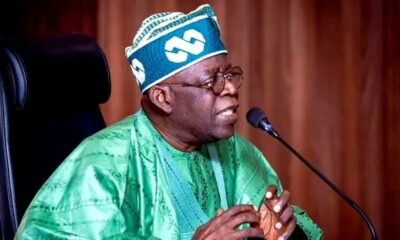

Breaking: Tinubu signs 4 tax reform bills into law

President Bola Tinubu, Thursday signed the four tax reform bills recently passed by the National Assembly into law.

Tinubu gave the presidential assent to the bills during a short ceremony at the Presidential Villa, attended by the leadership of the National Assembly and some legislators, governors, ministers, and aides of the President.

The four bills: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill, were passed by the National Assembly after extensive consultations with various interest groups and stakeholders.

They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.

The president also explained the importance of signing those tax bills into law, saying they are intended to put the country back on the path of economic recovery.

“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Onanuga said.

One of the four bills is the Nigeria Tax Bill (Ease of Doing Business), which aims to consolidate Nigeria’s fragmented tax laws into a harmonised statute.

“By reducing the multiplicity of taxes and eliminating duplication, the bill will enhance the ease of doing business, reduce taxpayer compliance burdens, and create a more predictable fiscal environment,” said the Presidency.

The second bill, the Nigeria Tax Administration Bill, will establish a uniform legal and operational framework for tax administration across federal, state, and local governments.

The Nigeria Revenue Service (Establishment) Bill, the third bill, repeals the current Federal Inland Revenue Service Act and creates a more autonomous and performance-driven national revenue agency— the Nigeria Revenue Service.

It defines the NRS’s expanded mandate, including non-tax revenue collection, and lays out transparency, accountability, and efficiency mechanisms.

The fourth bill is the Joint Revenue Board (Establishment) Bill.

It provides for a formal governance structure to facilitate cooperation between revenue authorities at all levels of government. It introduces essential oversight mechanisms, including establishing a Tax Appeal Tribunal and an Office of the Tax Ombudsman.

-

National News1 day ago

National News1 day agoBreaking: FG postpones NIS, NSCDC, other recruitment registration date, see new date

-

Metro News1 day ago

Metro News1 day agoFormer Kwara governor passes away

-

Politics2 days ago

Politics2 days agoINEC announces date for Ekiti gov’ship election

-

National News1 day ago

National News1 day agoPilot’s faulty seat caused Air India crash – Report

-

National News2 days ago

National News2 days agoNYSC extends service year of corps member for criticising Tinubu

-

Crime and Law1 day ago

Crime and Law1 day agoAgain! Bandits kill 20 soldiers in Niger

-

Education1 day ago

Education1 day agoBago orders immediate closure of Niger varsity

-

National News1 day ago

National News1 day agoBreaking: Tinubu announces date to sign tax reform bills into law