Politics

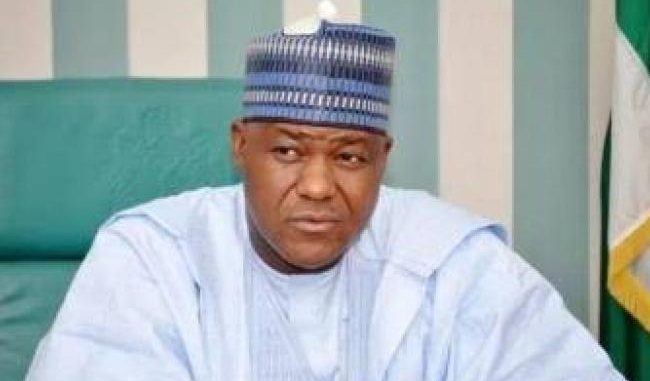

Tinubu appoints Yakubu Dogara

President Bola Ahmed Tinubu has approved the establishment of the National Credit Guarantee Company (NCGC), a transformative institution aimed at de-risking lending and boosting access to finance for Micro, Small, and Medium Enterprises (MSMEs), Small Corporations, Manufacturers, Consumers, and Large Enterprises across Nigeria.

In a significant move, the President has appointed Rt. Hon. Yakubu Dogara as the Chairman of the NCGC Board.

The NCGC, set to commence full operations in July 2025 with an initial capital of ₦100 billion from a consortium including the Ministry of Finance Incorporated (MoFI), Nigeria Sovereign Investment Authority (NSIA), Bank of Industry (BOI), and the Nigerian Consumer Credit Corporation (CreditCorp), aims to unlock credit and fuel sustainable economic growth. The World Bank Group will also provide technical assistance to the NCGC.

President Tinubu emphasized the initiative’s role in strengthening confidence in the financial system, expanding credit access, and supporting underserved groups such as women and youth, while driving growth, industrialization, job creation, and better living standards for Nigerians.

The NCGC Board, chaired by Dogara, includes Mr. Bonaventure Okhaimo as Managing Director/Chief Executive Officer, Mrs. Tinuola Aigwedo as Executive Director, Dr. Ezekiel Oseni as Executive Director of Strategy & Operations, and Ms. Yeside Kazeem as Executive Director of Risk Management and an independent Non-Executive Director.

Non-Executive Board Members include representatives from key stakeholders: MD, Nigeria Sovereign Investment Authority, Mr. Aminu Sadig-Umar (MD/CEO, Bank of Industry), Dr. Olasupo Olusi (MD, Nigerian Consumer Credit Corporation), Mr. Uzoma Nwagba (Ministry of Finance Incorporated), and Mrs. Oluwakemi Owonubi (Ministry of Industry).

Major stakeholders, including the NSIA, MoFI, BOI, and CreditCorp, were also appointed as shareholders, ensuring robust governance and operational support for the NCGC’s mission to transform Nigeria’s credit landscape.

-

Entertainment2 days ago

Entertainment2 days agoYul Edochie unveils face of newborn daughter

-

National News2 days ago

National News2 days agoSultan makes fresh announcement on Sallah celebration

-

National News2 days ago

National News2 days agoAmaechi a golden fish, an asset to my government – Buhari

-

Entertainment2 days ago

Entertainment2 days agoVerydarkman breaks silence on Davido, Cubana Chief Priest’s visit to Tinubu

-

Metro News21 hours ago

Metro News21 hours agoPanic as IBEDC staff electrocuted while fixing power line

-

Metro News2 days ago

Metro News2 days agoWike shuns Tinubu’s directive over unseal of PDP headquarters

-

National News1 day ago

National News1 day agoPopular Kenyan author, Ngugi Wa Thiong’o announced dead

-

Politics23 hours ago

Politics23 hours agoCUPP tags Tinubu’s 2 years in office as worse in history of Nigeria